Zerodha claims that investors of their platform have earned 50,000 crores in four years

Brokerage firm Zerodha claimed that investors investing in the stock market through their platform have earned a profit of Rs 50000 crore in the last four years. In the last five years, the stock market has registered an increase of 37000 points. In mid-2019, the Sensex was near 39500 points. On Tuesday, the Sensex closed at 76,456 points.

Congress leader Rahul Gandhi may be claiming a scam in the stock market, but in the last five years, investors have made tremendous profits from the market. On Tuesday, brokerage firm Zerodha claimed that investors investing in the stock market through their platform have earned a profit of Rs 50,000 crore in the last four years.

In the last five years, the stock market has registered an increase of 37,000 points. In mid-2019, the Sensex was close to 39,500 points. On Tuesday, the Sensex closed at 76,456 points.

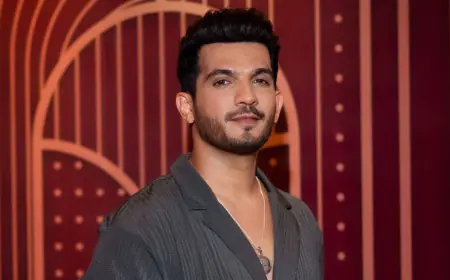

Zirodha co-founder Nithin Kamath claimed in a post on X that investors associated with his platform have cashed out profits of Rs 50,000 crore in the last four years and profits of Rs 1 lakh crore are visible in their accounts which they have not yet cashed out. This profit of Rs 1 lakh crore is in exchange for assets under management (AUM) of Rs 4.5 lakh crore.

The majority of the AUM has been added within the previous four years. The total value of mutual fund assets is referred to as AUM. The Association of Mutual Funds in India recently announced that the highest-ever investment in equities mutual funds was made in May.

The mutual fund's size was 10 lakh crore in 2014, and it has now grown to 56 lakh crore. On June 6, in response to Rahul Gandhi's allegations of a stock market scam, Commerce and Industry Minister Piyush Goyal stated that the market cap (market capitalization) of the market expanded from 67 lakh crore to 415 lakh crore over the last ten years during the Modi government's tenure.

The share of domestic investors in the market increased from 79 percent to 84 percent while the share of foreign investors decreased from 21 percent to 16 percent. Domestic and retail investors are earning profits from the market in some form or the other through various investments ranging from mutual funds to SIP.