Way of spending is changing in the middle class of India, is the income increasing or is the reason something else

Middle-Class Spending: According to a recent report, the way of spending is changing in the middle class of India. He no longer thinks like his ancestors before spending. However, the reason for the increase in this expenditure is surprising. People are spending more not because of the increase in income, but due to some other reason. Let us know about this in detail.

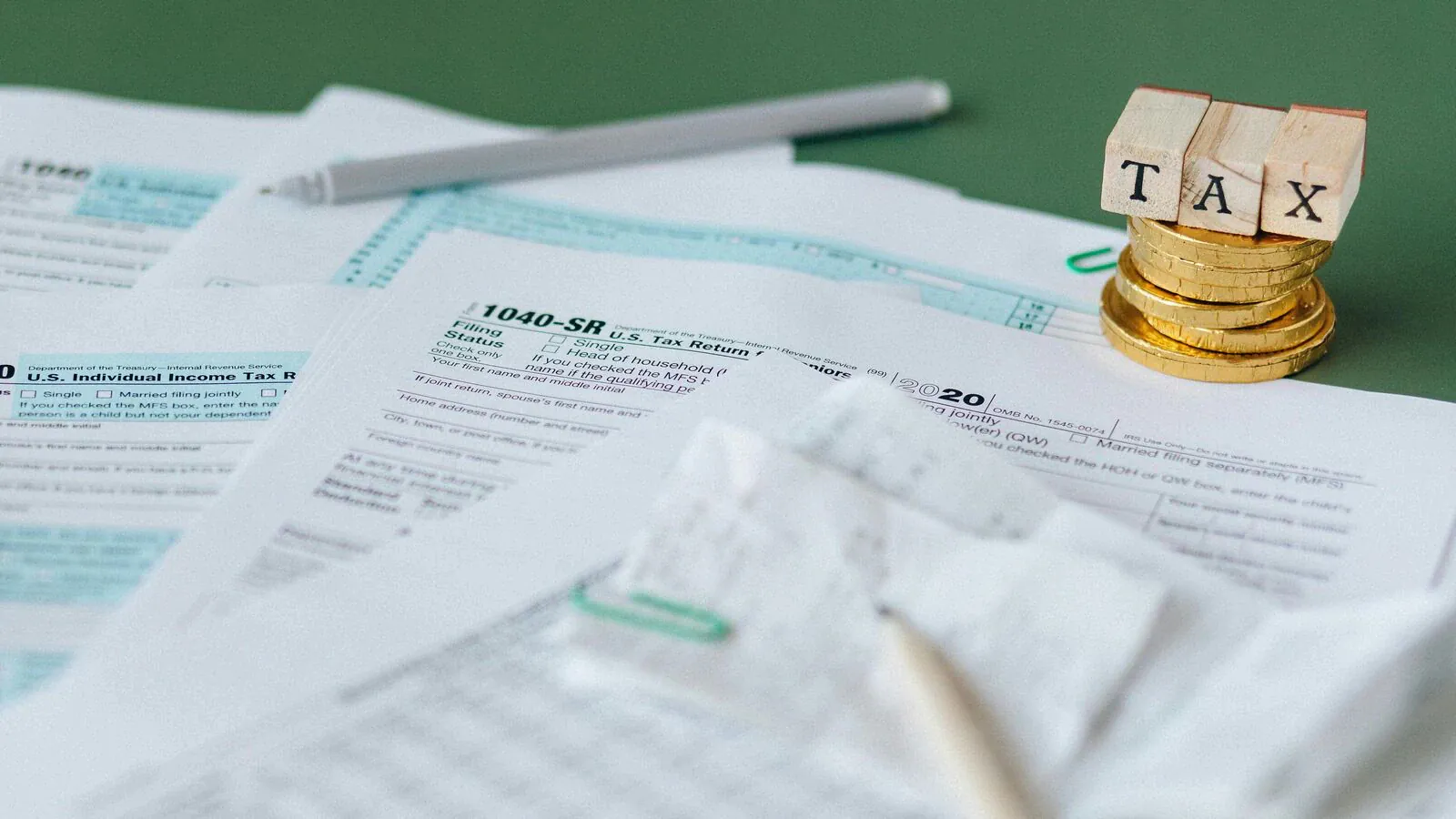

A major part of the economy of India, the most populous country in the world, runs on the consumption done by the common man. Private consumption contributes about 60% of the country's economy. One-third of this 60% block of private consumption is such spending, which can be termed as non-essential spending. This spending is done on entertainment, eating out, and holidays. Of course, the higher class of the country has a lion's share in this spending, but the common man or the middle class is also not far behind. One-third of the total non-essential spending is being done by the middle class.

According to a recent report, the spending pattern of India's middle class is changing. They no longer think before spending like their ancestors. For example, a family that used to bargain while buying groceries now easily spends money while buying a car. Similarly, a salaried professional in Indian society who used to bargain for household services plans luxurious vacations without any hesitation. However, the reason for this change is not at all the increase in people's savings. So what is the reason, let's know.

Oxford Economics estimates that the middle class in emerging markets will double in the next decade. The number of middle-class households will increase from 35.4 crores in 2024 to 68.7 crores by 2034. By 2029, two out of every three middle-class consumers are expected to be from Asia. The biggest increase in this will be from China, India, Indonesia, the Philippines, and Vietnam. On the other hand, if we talk about income, according to income tax data, the income of the middle class has remained stable in the range of about 10.5 lakhs per year for the last 10 years, but they are continuously increasing their expenses.

According to the report, the reason for the increase in non-essential expenditure among the middle class may be the increasing tendency to take loans. People are saving less, and borrowing more. Asia's third-largest economy is expected to grow at a rate of 7.2% in the financial year ending March 2025, which is the fastest compared to its major counterparts. Savings are decreasing in the middle class of the country, but the tendency to take loans is increasing rapidly. The Reserve Bank of India has also expressed concern over domestic debt levels. The demand for such loans has reached 41% of GDP and is estimated to go up to 43.5% in the first half of FY 2025. This figure indicates that people are spending more than their current income, increasing their financial burden.

The aspiration for a luxurious lifestyle has increased amongst the masses of the country. Now luxury is no longer the domain of the elite class only. Social media, simple availability of loans, and increasing disposable income have exposed the middle class to the gateway of adopting a premium lifestyle. The Indian consumer now aspires to spend on premium electronics, designer clothes, and compact luxury cars. Millennials and Gen Z are being attracted to boutiques, gyms, and premium lifestyle brands. As per a report 'Navigating Horizons', by 2034, Indians' expenditure on traveling abroad can be $ 55.39 billion. People are choosing boutique hotels and luxury holidays. Affordable but attractive destinations like Egypt, Azerbaijan, and Georgia are attracting more and more Indian travelers. Although there is low income in the country, the change in the priority of the middle class is also affecting the real estate sector. While people previously invested in low-cost housing, now they are investing in luxury flats and gated communities.

The consumption and debt trends among the middle class show that Indian consumers are willing to spend more, breaking away from traditional saving habits, to adopt a better lifestyle. This trend is accelerating economic growth but is also creating new challenges for long-term financial stability. It has become necessary for policymakers and financial institutions to decide on a future strategy in view of this changing scenario so that the economy can be saved from its negative impact.

For Latest News update Subscribe to Sangri Today's Broadcast channels on Google News | Telegram | WhatsApp

.jpeg)

.jpeg)