Stock markets will be more affected by monetary policy expectations

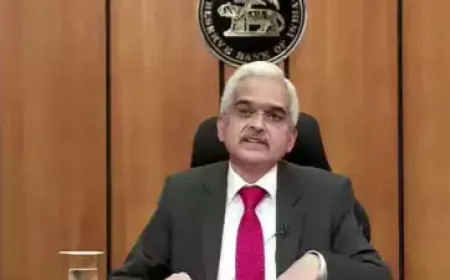

Monetary Policy: This is as markets digest policy announcements and traders adjust their portfolios throughout the day. This research paper titled Equity Market and Monetary Policy Surprises has been prepared by Mayank Gupta, Amit Pawar, Satyam Kumar Abhinandan Bord, and Subrata Kumar Seet of the Economic and Policy Research Department of RBI.

In the future, the stock market will be more influenced by monetary policy expectations than by unexpected changes in policy rates. According to a research paper by RBI officials, along with monetary policy, regulatory and development measures announced also affect the stock markets. The research paper said,

Going forward, equity markets will be more influenced by market expectations regarding monetary policy than unexpected changes in policy rates. It said that volatility in equity markets on the day of policy announcement is influenced by both factors.

This occurs as traders modify their portfolios throughout the day and markets process policy announcements. The Economic and Policy Research Department of the RBI's Mayank Gupta, Amit Pawar, Satyam Kumar, Abhinandan Borad, and Subrata Kumar Seit are the authors of the research paper, Equity Markets and Monetary Policy Surprises.

The paper analyzes the impact of monetary policy announcements on returns and volatility in the BSE Sensex by decomposing the changes in overnight indexed swap (OIS) rates on policy announcement days into target and path factors. The target factor captures the surprise component in central bank policy rate action, while the path factor captures the effect of the central bank's communication on market expectations about the future path of monetary policy.

.jpeg)