Stock market closed in red again; Sensex fell 153 points, Nifty below 25100

Sensex Closing Bell: BSE Sensex closed down 152.93 points at 81,820.12 and NSE Nifty slipped 70.60 points to close at 25,057.35.

On Tuesday, the domestic stock market ended the day down, giving up its early gains. The Sensex, which began trading at 81,820.12, ended the day down 152.93 points at 81,667.19. Nifty ended the day at 25,057.35, down 70.60 points.

Thirty companies out of the Nifty 50 fell, while eighteen increased. Top losses were Hindalco; top winners were BPCL, ICICI Bank, Bharti Airtel, Britannia, and Asian Paints; top winners were HDFC Life, Wipro, Bajaj Auto, and Bajaj Finance.

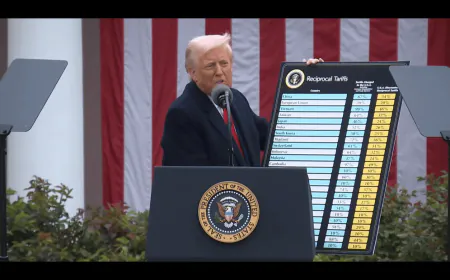

The decline in the market was ascribed to profit booking and worldwide trends by Vinod Nair, Head of Research at Geojit Financial Services. "The domestic market witnessed a decline, influenced by mixed global trends and partial profit booking," he said.

He further added that along with a decline in crude oil prices, which is positive for the local economy, it also suggests a slowing global demand. Also, a rise in food prices led to a jump in India's Consumer Price Index, probably delaying expected rate cuts. Besides, investors turned cautious due to the poor results of companies during the second quarter.

The recent decline in the market has been significant. The Sensex and Nifty have fallen 6 percent this month due to the global uncertainty and economic concerns of the domestic market. However, all sectors have not been beaten down by the overall negative sentiment. The Bank Nifty and financial services sectors have shown resilience and a sign of improvement has been seen from these counters. The market got support from the decision of the Monetary Policy Committee to keep the repo rate unchanged at 6.5 percent. The move can keep the liquidity intact in the financial sector, along with banking stocks. Realty, FMCG, IT, and energy were some other sectors where trading opportunities were seen; however, the action in these sectors was limited as stocks saw profit booking.

For Latest News update Subscribe to Sangri Today's Broadcast channels on Google News | Telegram | WhatsApp

.jpeg)

.jpeg)