Sa-Dhan calls the Karnataka Government’s Ordinance of Regulating the Microfinance Companies a positive step

Bengaluru (Karnataka) [India], February 17: Sa-Dhan, a Reserve Bank of India-recognised Self-Regulated Organisation (SRO) of Microfinance Companies and Impact Finance Institutions, has welcomed the ordinance issued by the Karnataka Government to control unregulated money lending institutions and organisations dealing in micro and small loans in the State. Sa-Dhan has called this Ordinance a positive step [...]

Bengaluru (Karnataka) [India], February 17: Sa-Dhan, a Reserve Bank of India-recognised Self-Regulated Organisation (SRO) of Microfinance Companies and Impact Finance Institutions, has welcomed the ordinance issued by the Karnataka Government to control unregulated money lending institutions and organisations dealing in micro and small loans in the State.

Sa-Dhan has called this Ordinance a positive step in bringing transparency and bolstering the RBI’s efforts to improve the country’s credit culture while lending to the needy and unbanked. It further stated that the Ordinance would supplement the Government of India’s efforts through the proposed enactment of the Banning of Unregulated Lending Activities (BULA). The SRO has further stated that the Ordinance would support its efforts in guiding, mentoring, and hand-holding microfinance companies to ensure good governance and ethical practices and adhere to guardrails issued by Sa-Dhan.

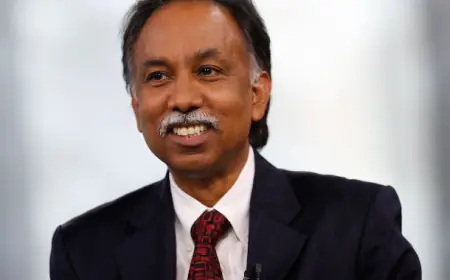

“The money lent by regulated microfinance is without any collateral and is regulated by the RBI’s regulatory framework, Fair Practices, and the Code of Conduct prescribed by SROs. Any breach of such regulations can be reported to the Grievances Redressal mechanism, including SROs and RBI Ombudsman, through toll-free numbers. Microfinance helps the poor to build a credit history,” said Jiji Mammen, Executive Director and CEO of Sa-Dhan.

According to Sa-Dhan, ‘microfinance’ is a well-chalked-out programme that supports poor households in accessing quality credit to satisfy their economic needs, as most microfinance borrowers cannot access credit from the formal banking system. Added Mr Mammen, ‘The Microfinance Institutions (MFIs) play a crucial role in financial inclusion and are regulated by the RBI or concerned laws of the State Governments, like the Trust Acts, Cooperative Acts, or the Society Acts while some are the Section 8 Companies. The Microfinance sector serves around 8.45 crore poor households whose annual income is less than Rs 3 Lakh as of 31 December 2024, and the combined portfolio of NBFC MFIs, NBFCs, Banks, Small Finance Banks, and other regulated microfinance institutions is at Rs 3.92 lakh crores as on 31 December 2024.

Karnataka, where the microfinance movement started in the country today, has the fourth-largest MFI portfolio in the country. The state alone houses about 65 lakh households, which have availed around Rs 40,000 crores in microfinance portfolio, a significant proportion of the overall lending pie in the country.

Sa-Dhan, the first and largest association of community development finance institutions in India, emphasised the relevance of microfinance in a State like Karnataka, where the microfinance movement first started with its ‘feet-on-street’ model wherein the loan is provided at the customers’ doorsteps. The action research programme of MYRADA and NABARD led to the SHG Bank linkage programme, the most extensive microfinance programme in the world, with a size of around Rs 2.5 lakh crore. The MFI movement also had its early roots in Karnataka.

If you have any objection to this press release content, kindly contact pr.error.rectification@gmail.com to notify us. We will respond and rectify the situation in the next 24 hours.