Paisabazaar Closes FY'23 at an Annualised Loan Disbursal Rate of Over Rs. 15,000 Crore

Paisabazaar, part of the PB Fintech Group, today announced that it has reached an annualised loan disbursal rate of over Rs 15,000 crore in March 2023. Paisabazaar registered a 76% year-on-year growth in loan disbursals, disbursing Rs.11,619 crore in FY 2023. FY disbursals grew @ 76% YoY; card issuance @>180%YoY Credit Cards issued through Paisabazaar grew at more than 180% year on year, reaching an annualised rate of over half a million credit cards issued in March 2023. Over 4.6 lakh credit cards were issued via the platform in the financial year. Paisabazaar also drives India's largest credit awareness initiative by offering consumers free credit report and score from all 4 credit bureaus. Over 3.49 crore consumers from 823 cities and towns across India had accessed their free credit report on Paisabazaar by the end of FY 23. According to Paisabazaar, around 14% of active bureau consumers in India, with at least 1 active credit product, have checked their credit score on its platform. Along with the scale of business, Paisabazaar has also focused on building stronger and sustainable margins, through improved processes, better offerings and higher conversions. Paisabazaar has been profitable (on adjusted EBITDA basis) since December 2022, ahead of guidance. Yashish Dahiya, Chairman and CEO, PB Fintech, said, "It has been a landmark year for Paisabazaar. Not only did it scale the business consistently, but also transformed it, becoming fundamentally stronger. As a result, it has grown with better margins and achieved profitability. With strong business fundamentals and a consumer-led focus at its core, along with a more digitally conducive ecosystem and low credit penetration in the country, the market opportunity for Paisabazaar is massive." Naveen Kukreja, Co-founder and CEO, Paisabazaar, said, "The lending ecosystem post the pandemic has evolved significantly, with sharper focus on building digital capabilities. As on-ground digitization becomes more real, we would be strongly placed to seamlessly cater to consumers across all credit segments. We had a strong year, and we are focused on continuing this momentum, through higher efficiency, sharper segmentation, deeper partnerships and consumer-focused innovations." A key pillar in Paisabazaar's long-term growth strategy is its co-created initiatives, aimed to meet supply, process or innovation gaps within the lending ecosystem. Paisabazaar till date has launched 6 exclusive products co-created with partner Banks and NBFCs like SBM Bank India, RBL Bank, IDFC First Bank, Federal Bank, DMI Finance and KreditBee. All these co-created products are available exclusively on the Paisabazaar platform and can be accessed through end-to-end digital processes. The co-created products also help drive trail revenue for Paisabazaar, helping build a steady revenue stream and improve margins. Through deeper engagements with partner Banks and NBFCs, Paisabazaar plans to steadily transition to a trail revenue-led business model that would lead to long-term profitability. In March 2023, 36% loan disbursals and 53% credit cards through Paisabazaar were with trail revenue. Paisabazaar says its focus would be on long-term growth and profitability. It would continue investing in its brand and digital capabilities, which would help build scale and improve margins. 77% of the credit cards issued through Paisabazaar in Q4 were done through end-to-end digital processes, while 43% of unsecured loans disbursed in the quarter were through completely digital processes using Paisabazaar's Digital Stack. There has been over 13X growth in the end-to-end digital transactions on Paisabazaar since the beginning of FY 22. Today, customer journeys with 13 partners are end-to-end digitized on the Paisabazaar platform. Paisabazaar, over the years, has become India's platform of choice with around 20 lakh consumers from 1000 cities and towns applying for a credit product in a month. According to Paisabazaar estimates, around 9% of credit enquiries in India take place on the Paisabazaar platform. Another key part of Paisabazaar's growth strategy is to help drive the economies of segmentation through depth and width of product offerings on its platform for consumers across all credit segments. About Paisabazaar Paisabazaar has earned the trust and goodwill of ~35 million consumers over the last 9 years. Paisabazaar has 65 partnerships with large banks, large NBFCs, credit bureaus and fintech lenders to offer a wide choice of lending products for consumers on its platform. Strong partnerships, built through technology and data integration enables Paisabazaar to offer consumers digital and easy processes and faster disbursals. From application to disbursal, Pai

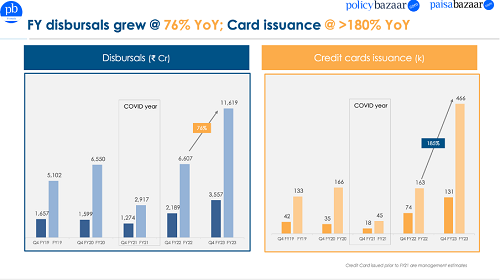

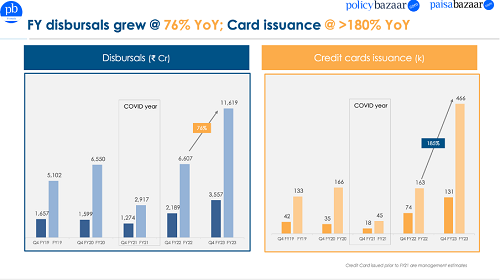

Paisabazaar, part of the PB Fintech Group, today announced that it has reached an annualised loan disbursal rate of over Rs 15,000 crore in March 2023. Paisabazaar registered a 76% year-on-year growth in loan disbursals, disbursing Rs.11,619 crore in FY 2023.

|

FY disbursals grew @ 76% YoY; card issuance @>180%YoY

Credit Cards issued through Paisabazaar grew at more than 180% year on year, reaching an annualised rate of over half a million credit cards issued in March 2023. Over 4.6 lakh credit cards were issued via the platform in the financial year.

Paisabazaar also drives India's largest credit awareness initiative by offering consumers free credit report and score from all 4 credit bureaus. Over 3.49 crore consumers from 823 cities and towns across India had accessed their free credit report on Paisabazaar by the end of FY 23. According to Paisabazaar, around 14% of active bureau consumers in India, with at least 1 active credit product, have checked their credit score on its platform.

Along with the scale of business, Paisabazaar has also focused on building stronger and sustainable margins, through improved processes, better offerings and higher conversions. Paisabazaar has been profitable (on adjusted EBITDA basis) since December 2022, ahead of guidance.

Yashish Dahiya, Chairman and CEO, PB Fintech, said, "It has been a landmark year for Paisabazaar. Not only did it scale the business consistently, but also transformed it, becoming fundamentally stronger. As a result, it has grown with better margins and achieved profitability. With strong business fundamentals and a consumer-led focus at its core, along with a more digitally conducive ecosystem and low credit penetration in the country, the market opportunity for Paisabazaar is massive."

Naveen Kukreja, Co-founder and CEO, Paisabazaar, said, "The lending ecosystem post the pandemic has evolved significantly, with sharper focus on building digital capabilities. As on-ground digitization becomes more real, we would be strongly placed to seamlessly cater to consumers across all credit segments. We had a strong year, and we are focused on continuing this momentum, through higher efficiency, sharper segmentation, deeper partnerships and consumer-focused innovations."

A key pillar in Paisabazaar's long-term growth strategy is its co-created initiatives, aimed to meet supply, process or innovation gaps within the lending ecosystem. Paisabazaar till date has launched 6 exclusive products co-created with partner Banks and NBFCs like SBM Bank India, RBL Bank, IDFC First Bank, Federal Bank, DMI Finance and KreditBee. All these co-created products are available exclusively on the Paisabazaar platform and can be accessed through end-to-end digital processes.

The co-created products also help drive trail revenue for Paisabazaar, helping build a steady revenue stream and improve margins. Through deeper engagements with partner Banks and NBFCs, Paisabazaar plans to steadily transition to a trail revenue-led business model that would lead to long-term profitability. In March 2023, 36% loan disbursals and 53% credit cards through Paisabazaar were with trail revenue.

Paisabazaar says its focus would be on long-term growth and profitability. It would continue investing in its brand and digital capabilities, which would help build scale and improve margins. 77% of the credit cards issued through Paisabazaar in Q4 were done through end-to-end digital processes, while 43% of unsecured loans disbursed in the quarter were through completely digital processes using Paisabazaar's Digital Stack.

There has been over 13X growth in the end-to-end digital transactions on Paisabazaar since the beginning of FY 22. Today, customer journeys with 13 partners are end-to-end digitized on the Paisabazaar platform.

Paisabazaar, over the years, has become India's platform of choice with around 20 lakh consumers from 1000 cities and towns applying for a credit product in a month. According to Paisabazaar estimates, around 9% of credit enquiries in India take place on the Paisabazaar platform. Another key part of Paisabazaar's growth strategy is to help drive the economies of segmentation through depth and width of product offerings on its platform for consumers across all credit segments.

About Paisabazaar

Paisabazaar has earned the trust and goodwill of ~35 million consumers over the last 9 years.

Paisabazaar has 65 partnerships with large banks, large NBFCs, credit bureaus and fintech lenders to offer a wide choice of lending products for consumers on its platform.

Strong partnerships, built through technology and data integration enables Paisabazaar to offer consumers digital and easy processes and faster disbursals.

From application to disbursal, Paisabazaar accompanies the Consumer at each step, providing last-mile assistance such as document collection and assistance until disbursal and advise.

Paisabazaar, since 2017, has also been providing consumers access to credit reports from credit bureaus, offering Consumers lifetime checking and tracking of their credit scores for free.

Paisabazaar has been recognized at several industry platforms with awards like 'Digital Lending Award' at the Fintech India Innovation Awards, 'Best Lending Fintech' at the Bharat Fintech Awards, 'Excellence in Consumer Lending' at IAMAI's India Digital Awards, 'Outstanding Crisis Finance Innovation (Asia Pacific) Award' by Global Finance Magazine, 'Most Innovative Lending Startup' and 'Best Fintech Consumer Lender' by India Fintech Forum and Economic Times' 'Most Promising Brand'.

![]()