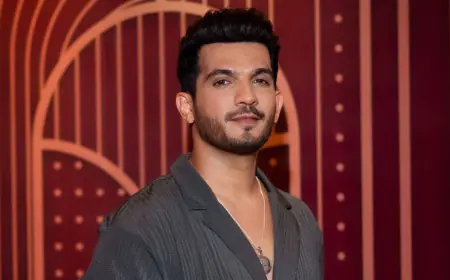

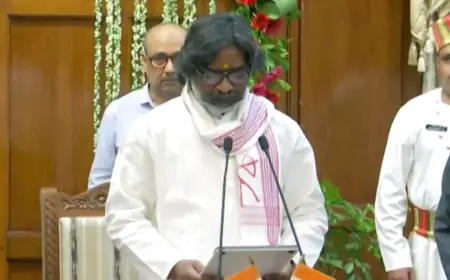

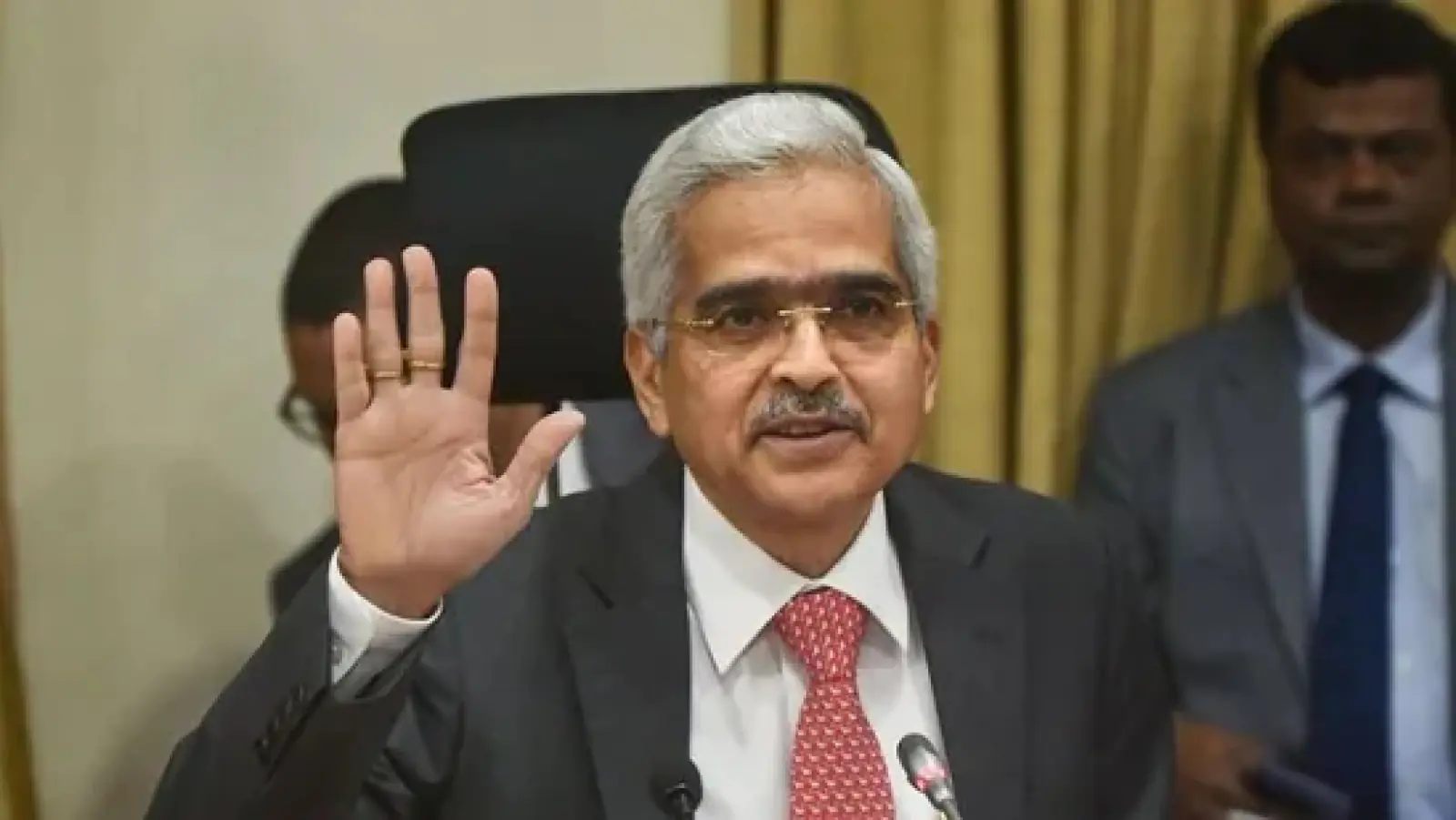

RBI Monetary Policy: Will loans become cheaper? RBI Governor Shaktikanta Das will announce monetary policy today

RBI Monetary Policy: RBI Governor Shaktikanta Das will announce the decisions of the RBI Monetary Policy Committee (MPC) meeting held from December 6 to 8 at 10 am today. Experts say that this time also RBI can keep the repo rate stable at 6.5 percent. If this happens it will be the fifth consecutive time when the interest rate will remain unchanged. Read the full news.

RBI Governor Shaktikanta Das will announce the decision taken in the Monetary Policy Committee (MPC) meeting of the Central Bank (RBI) held from 6 to 8 December at 10 am today.

This meeting started on Wednesday 6 December under the chairmanship of Governor Shaktikanta Das. According to experts, RBI can keep the repo rate stable at 6.5 per cent this time. If this happens, it will be the fifth consecutive time when the interest rate will remain unchanged.

Experts believe that RBI can keep the repo rate stable because the inflation rate in the country is gradually coming closer to the RBI's estimate and the economic growth rate is increasing.

Since February 2023, the RBI MPC has met four times and every time a decision was taken to keep the interest rate stable. The repo rate was last increased by 25 basis points in February 2023. The repo rate has been increased by 250 basis points or 2.5 per cent from May 2022 to February 2023.

According to the recent official report, due to a fall in food prices, retail inflation had come down to a four-month low of 4.87 per cent in October, which is less than the RBI estimate of 5.4 per cent.

The Monetary Policy Committee of RBI meets once every two months. This meeting lasts for three days during which policy decisions related to inflation in the country are taken. The most important among these decisions is the repo rate.

This is because if inflation is high in the country, then RBI reduces the money flow in the economy by increasing the interest rate i.e. repo rate, which reduces demand and inflation decreases.

On the contrary, when money flow in the economy needs to be increased, RBI makes the repo rate cheaper. Among these, the repo rate is the most important decision. The repo rate is the interest rate at which RBI gives loans to the banks of the country.