RBI governor's warning amid global banking crisis

RBI governor's warning amid global banking crisis: Indian banks should pay attention to the balance of the balance sheet, because of this crisis in America

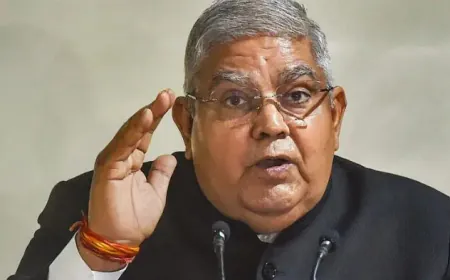

In view of the ongoing crisis in banks around the world, Reserve Bank of India (RBI) Governor Shaktikanta Das has given a big statement on Friday. Das warned the Indian banking sector that, 'they should pay attention to the balance of their balance sheet so that the balance of asset-liability does not get disturbed.'

In a public function, the RBI governor said, 'It is because of the imbalance of the balance sheet that the US banking sector is in trouble. Let us tell you that the banking sector crisis in America is not taking its name. After Silicon Valley Bank and Signature Bank, now First Republic Bank is also facing the threat of closure. However, 11 banks in America have come forward to save First Republic Bank from drowning.

RBI Governor Shaktikanta Das has been a vocal critic of private digital currencies. He said, 'The crisis in America's banking sector shows how big a threat private cryptocurrencies pose to the economy.'

The RBI governor said, 'The domestic financial sector is stable and the worst of inflation is over. "We have nothing to fear as the borrowings from foreign countries are manageable and hence the strengthening of the dollar poses no threat to us," he said.

RBI Governor Das focused on India's G20 chairmanship. He said, 'These 20 largest economies of the world should together help those countries, which have been badly affected by the strengthening of the US dollar.' He said, 'We should also come together for climate change financing and help the most affected countries on a war footing.'

Indian banks will not be affected by the bankruptcy of two big US banks. American investment company Jefferies and financial services firm Macquarie have expressed such confidence. They say that Indian banks are in a strong position due to reliance on local deposits, investment in government bonds and adequate cash.

For a few months, Indian banks have been performing better than foreign banks. According to Jefferies, most Indian banks have invested only 22-28% in securities. Government bonds account for 80% of banks' securities investments. Most of the banks keep 72-78% of these till maturity. This means that the fall in their prices will not affect this investment.