Paytm will generate free cash flow by the end of this year, revenue has increased by about 40 percent in Q1

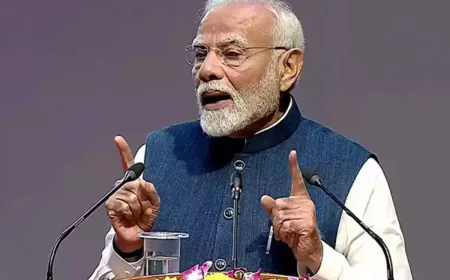

A senior official of payments and financial services provider Paytm said the company will generate free cash flow by the end of this year. Paytm founder and CEO Vijay Shekhar Sharma said the company's growth in the June quarter of 2023 was driven by the expansion of its payments financial and commercial businesses.

A top official of payments and financial services provider Paytm said the company will generate free cash flow by the end of this year.

Free cash flow is the cash that is left over after a company has paid for its operating expenses (OpEx) and capital expenditures (CapEx). Paytm founder and CEO Vijay Shekhar Sharma said the company's growth in the June 2023 quarter was driven by expansion in payments, financial services, and commerce business.

Sharma said that "We are on our committed guidance of making free cash flow positive by the end of the year

Releasing the results for the first quarter of FY24, which ended on June 30, it was told that the company's loss has come down to Rs 358.4 crore, which was a loss of Rs 645.4 crore in the same period a year ago.

Releasing the first quarter results, Paytm said that its revenue from operations grew by 39.4 percent to Rs 2,341.6 crore during the reported quarter from Rs 1,679.6 crore in the June 2022 quarter.

The company said its merchant payment volume (GMV) grew 37 percent year-on-year to Rs 4.05 lakh crore in the April-June quarter of FY 2023-24.

CEO Vijay Shekhar Sharma shared an update on Paytm Payments Bank's ban on adding new customers by RBI, Sharma said that it has submitted a compliance report to the banking regulator, and the same is being reviewed and is expected soon.

During the financial year (FY) 2022, the RBI directed Paytm Payments Bank (PPBL) to stop onboarding new customers from March 1, 2022. In FY23, the RBI said it appointed an external auditor to conduct a comprehensive system audit of PPBL.