Oxfam report: 1% rich have more than 40% wealth of the country, 50% population have only 3% wealth

Big disclosure in Oxfam report: 1% rich have more than 40% of the wealth of the country, 50% population has only 3% wealth

India's richest 1% now own more than 40% of the country's total wealth. Oxfam has given this information in one of its recently released reports. In this study, Oxfam has also told that half of the country's population i.e. 50% has only 3% of India's total wealth.

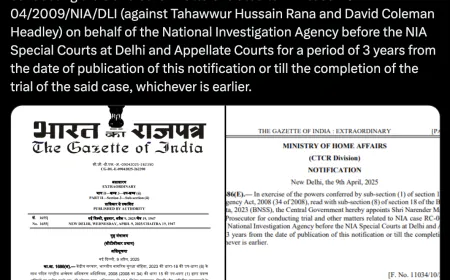

Releasing the India Supplement to its Annual Inequality Report on the first day of the World Economic Forum's annual meeting, rights group Oxfam International said a 5% tax on India's 10 richest people could fully fund the schooling of all the country's children. Is.

Oxfam said, 'Only one billionaire Gautam Adani can get Rs 1.79 lakh crore from a one-time tax on unrealized gains between 2017 and 2021. With this money, 5 million i.e. 50 lakh Indian primary school teachers can be given a salary for one year.

Oxfam has titled its report 'Survival of the Richest: The India Story'. In the report, Oxfam further said, 'If India's billionaires were taxed once on their total wealth at the rate of 2%, it would meet the need of Rs 40,423 crore to nourish the malnourished people in the country for the next three years. can go.

According to the report, a one-time tax of 5% on the country's 10 richest billionaires can raise Rs 1.37 lakh crore, which will be shared between the Ministry of Health and Family Welfare (Rs 86,200 crore) and the Ministry of AYUSH (Rs 3,050 crore) for 2020-2023. 1.5 times more than the estimated funds of Rs.

The report on Gender in Equality states that female workers get only 63 paise for every Re 1 earned by a male worker. The difference is even greater for scheduled cast and rural workers. The Scheduled Castes earned 55% of the earnings of the social groups, and subsequently only half of the urban earnings between 2018 and 2019.

A 2.5% tax on the top 100 Indian billionaires and a 5% tax on the top 10 would provide almost the entire amount needed to get children back to school. Oxfam said the report blends qualitative and quantitative information to explore the impact of inequality in India.

Secondary sources such as Forbes and Credit Suisse have been used to look at wealth inequality in the country and the wealth of billionaires. While government sources like NSS, Union Budget documents, parliamentary questions etc. have been used to corroborate the arguments made through the report.

Oxfam said that billionaires in India have seen their wealth grow by 121% or Rs 3,608 crore per day since the start of the pandemic till November 2022. On the other hand, about 64% of the total Rs 14.83 lakh crore in Goods and Services Tax (GST) came from 50% of the population in 2021-22. On the other hand, only 3% of GST was received from the top 10.

Oxfam said that the total number of billionaires in India has increased from 102 in 2020 to 166 in 2022. The combined wealth of India's 100 richest people has reached $660 billion (Rs 54.12 lakh crore). This is an amount that can fund the entire Union budget for more than 18 months.

Oxfam India CEO Amitabh Behar said, “The country's marginalized—Dalits, Adivasis, Muslims, women and informal sector workers—suffer in a system that ensures the survival of the richest.

Behar said, “The poor are paying more taxes. are spending more on essential goods and services than the wealthy. The time has come to tax the rich and ensure that they pay their fair share.

Behar urged the Union Finance Minister to implement progressive tax measures such as the Wealth Tax and the Inheritance Tax, which have historically proven effective in tackling inequality.

Citing a nationwide survey by Fight Inequality Alliance India (FIA India) in 2021, Oxfam said it found that more than 80% of people in India support taxes on the rich and corporations, which have taken the brunt of the COVID-19 pandemic. Earned record profits during the period.

For Latest News update Subscribe to Sangri Today's Broadcast channels on Google News | Telegram | WhatsApp

.jpeg)

.jpeg)