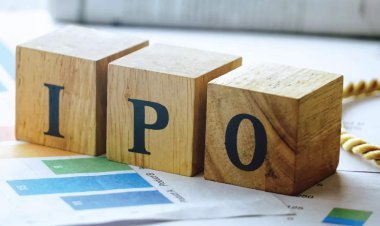

Online Gaming companies have so far received show cause notice of Rs 1 lakh crore, names of these big companies are included

GST authorities have so far sent show cause notices worth Rs 1 lakh crore to online gaming companies, a senior official said today. These companies are accused of tax evasion. Apart from this, the official also said that there is no information about the registration of foreign gaming companies in India after October 1. Read the full news.

A tax of 28 percent has started on online gaming, casinos, and horse racing in the country from October 1, 2023. Also, under the new laws, it has now become mandatory for foreign gaming companies to register in India.

In view of this, today a senior official said that GST officials have so far issued show cause notices worth Rs 1 lakh crore to online gaming companies for tax evasion.

Apart from this, the official also said that after October 1, no data has been revealed yet regarding the registration of foreign gaming companies in India.

The government has amended the GST law to impose 28 percent GST on online gaming, casinos, and horse racing and to register foreign gaming companies.

Several online gaming and casino operators like Dream11 and Delta Corp received GST show cause notices last month for short payment of tax. A separate show cause notice was sent to Gamescraft in September last year for alleged GST evasion of Rs 21,000 crore.

In the 50th GST meeting chaired by Finance Minister Nirmala Sitharaman, it was decided to impose 28 percent GST on the full face value of online gaming, casinos, and horse racing.

However, after this decision, online gaming companies strongly opposed it and urged the government to reconsider it. The government also reconsidered this and said again that the tax of 28 percent would remain.

However, the government also said that this decision will be reviewed after 6 months of implementation of this law. Accordingly, this decision which came into effect on October 1, 2023, will now be reviewed at the end of April 2024.