New update brought about Rs 2,000 note, more than two-thirds returned

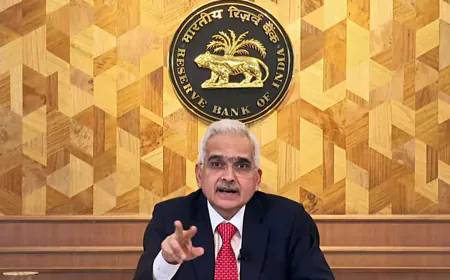

2000 Note Return: In the month of May, the governor of RBI made a big announcement regarding the note of 2000 rupees. Now this note is being taken out of circulation. Regarding the note of 2000 rupees, the governor of the Reserve Bank of India has told that two-thirds of the note has been returned in a month. You can deposit this note till 30 September.

In the month of May, the Central Bank of India made a big announcement regarding the 2000 rupee note. Now this note is being taken out of circulation. People can deposit this note in the bank till 30 September 2023. At present this note can be used legally.

Reserve Bank of India Governor Shaktikanta Das said about the Rs 2000 note that since May till now i.e. within a month, more than two-thirds of the Rs 2,000 notes have returned to the system.

The decisions taken in the second monetary policy review of the financial year have been announced on the 8th of this month. While announcing the monetary policy, Das had said that Rs 2,000 notes amounting to around Rs 1.8 lakh crore is now back in the system. While these notes were in circulation till March 31, only about 50 percent were in circulation in the market. About 85 percent of the notes have been deposited in it. The rest of the notes are still running in the market. That means people are still handling those notes.

PTI did an interview last week at the RBI headquarters. In this interview, Governor Das said that till the middle of last week, more than two-thirds or Rs 2.41 lakh crore worth of notes are now back in the system.

The central bank has fixed September 30, 2023, as the last day for note exchange or deposit. People are in a hurry to deposit the notes. On this, Das said that this time limit is not a line of stone. People need not rush to deposit or exchange money.

In the last monetary policy, it was decided to keep the repo rate constant. Governor Das had said that the withdrawal of notes would not affect monetary stability. On the other hand, according to a recent analyst report, consumer spending will increase after the circulation of 2000 notes. In such a situation, there may be an increase in the repo rate to further the economy. Right now the repo rate is 6.5 percent.