More than 12 thousand fake companies are registered in GST, officials will find out using biometric

Fake GST Registration: Several steps are being taken to prevent fake GST cases in the country. CBIC is now considering using biometric authentication to stop GST evaders. After this, the process of return filing will become very strict. Let us know what steps are being taken by the government on this.

In view of GST tax evasion, several campaigns are launched by the central and state authorities to catch the culprits of fake GST registration and tax evasion. Many people are also evading GST through other person's PAN and Aadhaar. It is very important to crack down on them.

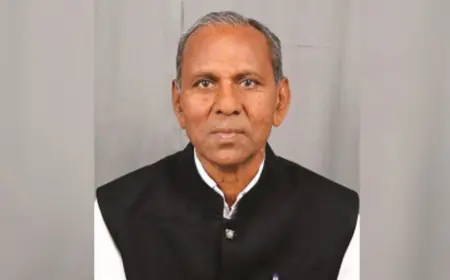

Various techniques are being used to strengthen the GST registration process. Regarding this, CBIC Chairman Vivek Johri told that now biometric authentication will be used. This helps in curbing fraudsters who misuse the PAN and Aadhaar of other people to get GST registration.

Along with this, he further said that the tax authorities are also considering some more strictness in the GST return filing process to limit the scope of claiming Input Tax Credit (ITC).

Any authorized representatives or directors or partners of the company shall have fresh registration by biometric authentication. If included in the registered under Goods and Services Tax (GST) then they can be processed. If the tax authorities suspect that these applications are being made for fraudulent claiming of ITC, then strict action may be taken after investigation.

In addition, plans are also being made for geo-tagging of all entities by the officials of the Central Board of Indirect Taxes and Customs (CBIC). From this, it can be certified whether the information provided during GST registration is correct or not.

As of now biometric authentication and geo-tagging are being implemented in a few states of the country. Soon it will be launched across India.

The CBIC chief informed that during the ongoing drive against fake registrations, GST officials have identified around 12,500 fake entities. This was done to claim bogus ITC and cheat the exchequer. There are some places like Delhi, Haryana, and Rajasthan where fake entities are present on a large scale.

Simultaneously, fake businesses with GST registration are running in Gujarat, Noida, Kolkata, Assam, Telangana, Tamil Nadu, and parts of Maharashtra. Businesses related to metal or plastic scrap and waste paper involve more cases of bogus GST.

To check bogus ITC claims, the tax authorities are planning to tighten the return process. Right now taxpayers have been given an exemption on how much ITC they will be able to claim in GSTR-2A. This exemption has been given because many traders were expressing concern about it.

CBIC Chairman Vivek Johri pointed out that the GST Council, consisting of finance ministers of the Center and states, has already taken several steps, including the sequential filing of monthly returns, to curb bogus ITC in the system.