Manufacturing: Register packing machinery in GST before October 1, failure to do so will result in a fine of one lakh

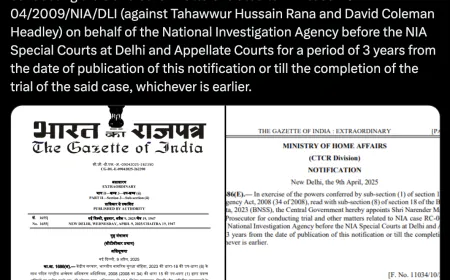

Manufacturing: Packing machinery has come under the purview of GST after an important decision by the Central Board of Indirect Taxes and Customs (CBIC). The government has said that people using these machines will have to register within the next two months. Failure to do so can result in a fine of one lakh.

The government has made it mandatory that manufacturers of products like pan masala, gutkha, and tobacco register packing machinery in GST before October 1. If it is not done, one will have to pay a fine of one lakh. The CBIC had announced the commencement of the process of registration and filing of monthly returns under GST by makers of these products from April 1. The date was later extended to May 15. The GST law was amended in the Finance Bill of February 2024.

This will also apply to any manufacture of pan-masala, hookah, or tobacco with or without any brand name, smoking mixture for pipe cigarettes, chewing tobacco not containing lime tube, filter khaini, zarda scented tobacco, and branded or non-branded gutkha.

It said that the firms, which operate across more than one state and have branches in those states and distribute general input tax credit distributed by them, will have to get themselves registered with the GST authority as input service distributors before April 1, 2025. This was brought in through the Finance Bill.

For Latest News update Subscribe to Sangri Today's Broadcast channels on Google News | Telegram | WhatsApp

.jpeg)

.jpeg)