June's retail inflation data will be released today, RBI Governor said - 4% inflation target is not easy

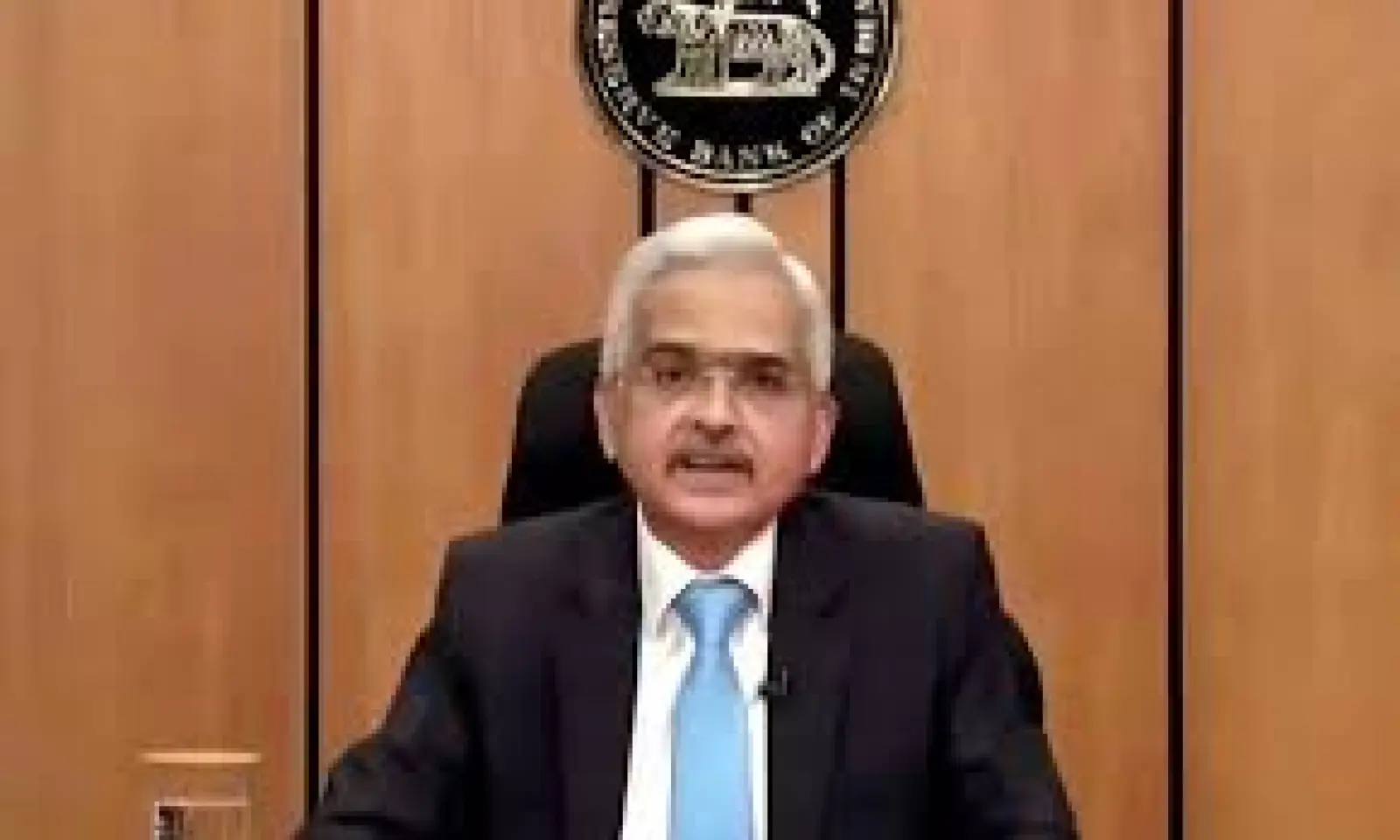

Inflation: RBI Governor Shaktikanta Das says that interest rate cut will have to wait till retail inflation comes to four percent. He said, given the difference between the current rate of inflation and the target of bringing it to four percent, the question of change in the stance on the policy rate does not make any sense right now.

After the scorching heat, now due to rain, the prices of green vegetables including tomatoes, potatoes and onions have increased. On the other side, RBI Governor Shaktikanta Das says that interest rate cut will have to wait till retail inflation comes to four percent. He said that given the distance of the current rate of inflation from the target to bring it to four percent, the question of change in stance over the policy rate does not make any sense right now.

The moment we move towards bringing retail inflation to four percent on a sustainable basis, we will get the confidence to think about a change in stance, Das said on Thursday. The work of bringing inflation in line with the target is progressing as per expectation, but four percent target is last stop and it's not easy.

Now, in its bi-monthly monetary policy review presented in June, RBI has projected retail inflation at 4.5 per cent for the current financial year 2024-25. It is likely to be 4.9 per cent in the first quarter of 2024-25, 3.8 per cent in the second, 4.6 per cent in the third, and 4.5 per cent in the fourth quarter.

Speaking on GDP, the governor of RBI said many elements that accelerate economic growth are playing their role well. The growth rate in the fourth quarter was very strong in the last financial year 2023-24, and it remains equally strong in the first quarter of the current financial year.

It had also told in the June monetary policy review that private consumption is getting more and, demand is also improving in rural areas. For these very reasons, RBI increased the GDP growth rate for the current financial year from seven percent to 7.2 percent.

Das said that though there was further softening in core inflation during March-April, its effect was not seen because of high prices of food items. Inflation of pulses and vegetables remained in double digits despite some softening. Vegetable prices are increasing in summer after showing a slight improvement during the winter season. It was for the 11th consecutive month since June 2023 that there was softening in core inflation.

With this, the pressure on RBI for a cut in the repo rate has started increasing. Jayant R Verma and Ashima Goyal—the two external members of the central bank interest rate-setting committee—are pitching for at least a 0.25 percent cut in the repo rate. The repo rate has been at 6.5 percent without any change for eight consecutive times now.

Economists say retail inflation may go up to 4.80 percent in June due to a sharp increase in prices of vegetables. It was 4.75 percent last month. Sharp rise in the prices of vegetables along with cereals and pulses had kept the food inflation at high level, said Chief Economic Advisor to Union Bank of India Kanika Pasricha. Government will soon release retail inflation data for the month of June on this Friday.

For Latest News update Subscribe to Sangri Today's Broadcast channels on Google News | Telegram | WhatsApp

.jpeg)

.jpeg)