India's foreign exchange reserves rise again, rebound after several weeks of decline

Foreign Exchange Reserves: India's foreign exchange reserves have started rising again after eight consecutive weeks of decline, hitting a multi-month low. Earlier, the reserves were declining since touching an all-time high of US$ 704.89 billion in September.

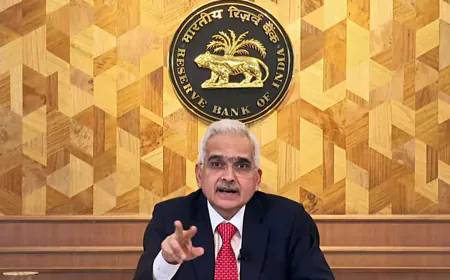

After a decline for eight continuous weeks, the streak marking the multi-month low, foreign exchange reserves in India started to rise once again. For the week ended November 29, foreign exchange reserves rose by US$ 1.510 billion to US$ 658.091 billion, data from the Reserve Bank of India (RBI) showed earlier this week.

The reserves had been declining since touching an all-time high of US$ 704.89 billion in September. The reserves are falling as RBI is intervening to prevent a sharp devaluation of the rupee. An adequate foreign exchange reserves buffer helps insulate domestic economic activity from global shocks. The latest data from the RBI showed that the foreign currency assets (FCA), the largest component of forex reserves, stood at US$568.852 billion. As per the RBI data, the gold reserves now stand at US$66.979 billion.

At the same time, estimates are that the foreign exchange reserves of India now reach a sufficient level to pay for about one year of projected imports. In value terms, India added around US$58 billion to its foreign exchange reserves in 2023, while there was a cumulative decline of US$71 billion in 2022. Foreign exchange reserves or FX reserves are assets held by a country's central bank or monetary authority, mostly in reserve currencies such as the US dollar, with a small share in the euro, Japanese yen, and pound sterling.

It carefully watches over foreign exchange markets and only tries to intervene when the maintenance of orderly market conditions to prevent undue fluctuations in the exchange value of rupees is necessary. And again, this has not followed any fixed target or a band as such. Normally, such intervention by the RBI includes measures to mop up rupee liquidity, by even selling the dollar. The Indian rupee had been among Asia's most volatile currencies a decade ago. Since then, it has become one of the most stable currencies. The RBI has opportunistically bought dollars when the rupee is hard and sold when it is weak, making Indian assets more attractive for investors.