Indian Overseas Bank is expanding its business, know what the new plan

In honour of its 88th Foundation Day, Indian Overseas Bank has planned an expansion strategy that includes the opening of 88 new branches this year. The bank, which has its headquarters in Chennai, debuted IOB Freedom Savings and Current Account versions of the RuPay credit card. In addition, there has been an instantaneous 20 basis point increase in interest rates for 444 days on Rupee Retail Term Deposits.

In honour of its 88th Foundation Day celebration, the public sector Indian Overseas Bank has planned to open 88 new branches this year, a top official announced on Saturday.

The bank with its headquarters located in Chennai announced the launch of digital document execution for online locker agreements, IOB Freedom Savings and Current Account variants, and RuPay credit card variants.

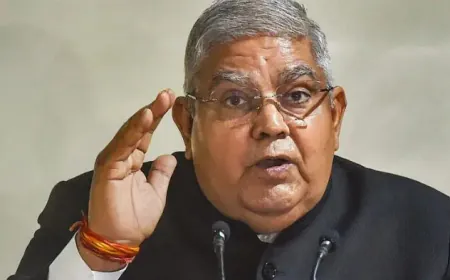

Ajay Kumar Srivastava, the managing director of the bank, announced that 88 new branches would be opened this year after paying respect to the late M C T M Chidambaram Chettiar, who founded the institution on this day in 1937.

According to him, the Bank's audacious expansion plan is a reflection of its unwavering commitment to providing comprehensive financial services, which in turn fosters inclusivity and economic vibrancy in communities all over the nation.

Indian Overseas Bank said it has increased interest rates on Rupee Retail Term Deposits for 444 days by 20 basis points with immediate effect. Along with this, retail term, depositors will get a 7.30% interest rate on term deposits of 444 days, senior citizens will get a 7.80% interest rate and super senior citizens will get an 8.05% interest rate.

On this occasion, the Bank's Chief Executive Officer Srivastava handed over 11 tricycles and nine wheelchairs to the disabled persons through Ramakrishna Math here.