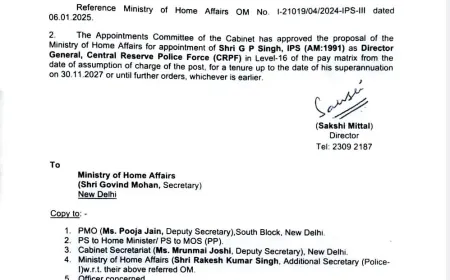

Hotel-hospital cash transactions will now be subject to income tax action

Income Tax: Hotels and hospitals evading tax by transacting in cash have come under the radar of the Income Tax Department.

Dragging hotels and hospitals outside the purview of tax for dealing in cash, Income Tax Department parameters The Central Board of Direct Taxes (CBDT) has instructed the Income Tax Department to probe cash payments in establishments such as hotels, hospitals, and IVF clinics. The CBDT also asked us to take care of the investigation and not interfere unnecessarily so that no one's job is affected. For the second time in a week, CBDT officially said on I-T raids that many complaints have been received for a long that instead of online transactions (cheques, etc) Hotels/Hospitals/Lsbranded outlets - hospitals, and chemical diagnostic services institutions are giving emphasis to cash.

Subject expert Archit Gupta said that according to the rules, it is necessary to tell cash transactions of more than two lakh rupees through the statement of financial transaction (SFT). But, this information was not given. Sandeep Aggarwal, Joint Secretary of All India Federation of Tax Practitioners, said that CBDT has targeted high-value businesses. Now under this action plan, strict vigil will be kept on them and the IT department can also make a recovery.