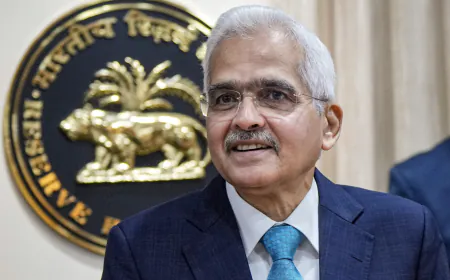

Government made windfall tax on crude oil zero, country's crude oil companies will benefit

Windfall Tax: On Tuesday, the government reduced the windfall tax on domestically produced crude oil to zero per tonne from September 18. The government has issued a notification. An official notification said that the new rates are effective from September 18. This move of the government will greatly benefit the companies exporting crude oil in the country.

The government, on Tuesday, reduced the windfall tax on domestically produced crude oil to zero per tonne with effect from September 18. According to an official notification, the new rates have come into effect from September 18. The step by the government will significantly prove beneficial for the companies exporting crude oil in the country.

The tax is levied as Special Additional Excise Duty (SAED) and is notified fortnightly based on average oil prices in two weeks. The last such amendment had come into effect from August 31 when the government reduced the windfall profit tax on crude petroleum from Rs 2100 per tonne to Rs 1850 per tonne.

The SAED on the export of diesel, petrol, and jet fuel or ATF has been retained at 'zero'. India had for the first time imposed a tax on windfall profits on July 1, 2022, joining a list of countries that tax extraordinary profits of energy companies.