Government introduced the draft of the Digital Personal Data Protection Bill, now your personal details will be safe

Digital Personal Data Protection Bill 2022: The government introduced the draft of the bill, now your personal details will be safe

The Government of India presented the draft of 'Digital Personal Data Protection Bill 2022' on Friday. The purpose of this bill is to provide regulation around digital personal data. The new bill recognizes both the right of individuals to protect their personal data and the need to process personal data for legitimate purposes. In this bill, the government has increased the penalty amount to Rs 500 crore for misuse of people's personal data i.e. companies breaking the law.

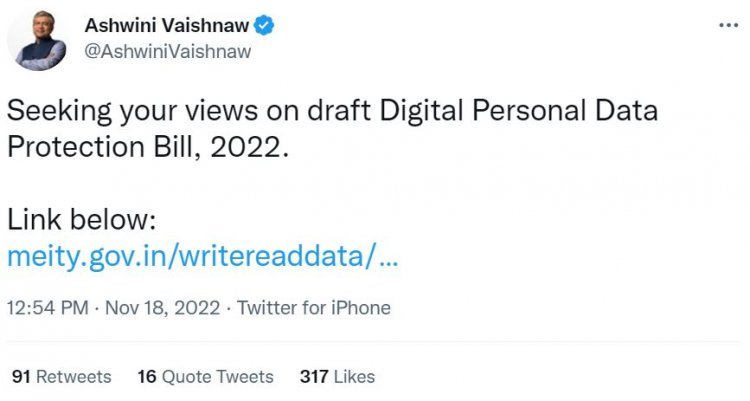

The previous data protection bill was scrapped during the parliamentary monsoon session earlier this year. Now the ministry has changed its name to Personal Data Protection Bill, which completely emphasizes the laws related to user data. Union Minister of Railways, Communications, Electronics and Information Technology Ashwini Vaishnav has also sought people's opinions on the draft Digital Personal Data Protection Bill 2022 by sharing a post on social media.

This draft revolves around some of the most popular social media and other tech companies. The Digital Personal Data Bill states that companies collecting data must stop holding personal data, or remove the means by which personal data can be associated with a particular data principal.

The draft also states that users' data should not be retained unless required for legal or business purposes. The new Personal Data Protection Bill also gives full rights to the owner of the biometric data. Even if an employer required biometric data of an employee to mark attendance, it would explicitly require consent from the employee.

The new Personal Data Protection Bill will affect KYC data as well. Restrictions are required to complete the KYC process every time a savings account is opened. The data collected under this process also comes under the purview of the new Data Protection Bill. Bank has to maintain KYC data for more than 6 months after account closure.

A new set of rules have also been put in place for the collection and retention of the personal data of children. Companies seeking data will require the consent of a parent or guardian to access the data. Social media companies will also have to ensure that children's data is not being tracked for targeted advertising.

For Latest News update Subscribe to Sangri Today's Broadcast channels on Google News | Telegram | WhatsApp

.jpeg)

.jpeg)