Foreign investors' trust in Indian stock market is increasing again, bought shares worth Rs 12170 crore in June

In May, there was a lot of uncertainty in the minds of foreign investors about the election results. They had made a net withdrawal of Rs 25586 crore from shares. But now they know that the Modi government has returned to power and most of the ministries are also with the old ministers. In such a situation, the government will try to increase economic growth by continuing its old policies.

With the start of the Lok Sabha elections, foreign portfolio investors (FPIs) started distancing themselves from the Indian stock market, because during that time the instability in the market had increased a lot. When the voting in the initial stages was less than expected, the concern of foreign investors increased and they increased the selling more.

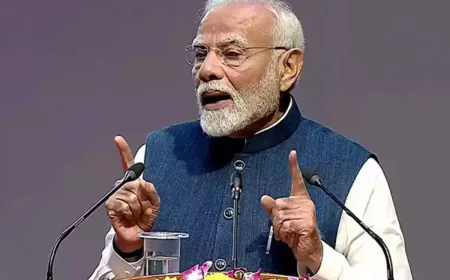

However, since the formation of the NDA government under PM Narendra Modi, foreign investors' concerns have been significantly alleviated, and they have resumed investing. According to data as of June 21, foreign investors had made a net investment of Rs 12,170 crore in the Indian stock market. Experts believe that this trend will persist.

Foreign investors were deeply concerned about the election results in May. They made a net withdrawal of Rs 25,586 crore from the stock market. However, they are now aware that the Modi government has returned to power, and the majority of ministries are still led by the same ministers. In such a situation, the government will try to increase economic growth by continuing its old policies.

According to the data of the depository, due to election uncertainty, FPIs withdrew Rs 25,586 crore from equity markets in May and Rs 8,700 crore in April. Apart from this, FPIs had also withdrawn for the last few months due to changes in the tax treaty with Mauritius and an increase in US bond yield.

With the fresh investment, the total withdrawal of FPIs from equity in the calendar year 2024 has come down to Rs 11,194 crore. Sunil Damania, Chief Investment Officer, MozoPMS, says that due to high valuations, FPI investment in equity markets will remain limited in the coming times. In the calendar year 2024, FPIs have been withdrawing so far except in March.

Foreign portfolio investors have been consistent buyers in the domestic bond markets. FPIs have invested Rs 10,575 crore so far in June. FPI investment in the bond market in 2024 has increased to Rs 64,244 crore.