Effect of withdrawal of 2000 rupee notes: cash in the market is continuously decreasing

Effect of withdrawal of 2000 rupee notes: cash in the market is continuously decreasing, 83 thousand crores reduced to 32.88 lakh crore rupees

After the announcement of the withdrawal of the 2000 rupee note by RBI, the cash in the market is continuously decreasing. According to RBI, till June 2, the total cash with the people has come down by Rs 83,242 crore to Rs 32.88 lakh crore.

In the fortnight ending June 2, the number of bank deposits increased by Rs 3.26 lakh crore to reach Rs 187.02 lakh crore. According to the Reserve Bank data, the amount of bank deposits decreased by Rs 59,623 crore to Rs 183.74 lakh crore in the last fortnight ending May 19, 2023.

RBI Governor Shaktikanta Das had told on June 8 that Rs 2,000 notes worth Rs 1.8 lakh crore have returned to the system. He had said that these notes are about 50% of the total circulation.

While announcing the note withdrawal on May 19, the RBI had said that the total value of Rs 2,000 notes as of March 31 was Rs 3.62 lakh crore.

RBI has asked to exchange 2000 notes in banks or deposit in accounts till 30 September but has also said that it will remain legal even after this. This is only to encourage people to return these notes to the banks.

Only notes worth a maximum of twenty thousand rupees will be changed at a time, but there will be no limit on depositing these notes in the account. Now banks will not issue 2000 notes.

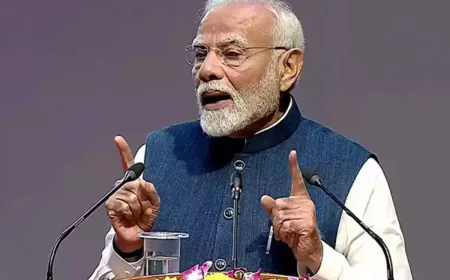

2 thousand notes came on the market in November 2016. Then Prime Minister Narendra Modi closed 500 and 1000 notes. Instead, a new note of 500 and 2000 was issued in the new pattern. RBI has stopped printing 2000 notes from the year 2018-19.