CII suggested a 10-point agenda for business reforms before the budget; Know what is the objective

Budget 2025: CII Director General Chandrajit Banerjee said, 'Simplifying the regulatory framework, reducing compliance burden and increasing transparency should remain our key agenda for the next several years. It is necessary to reduce compliances in many areas such as land, labor, dispute resolution, taxes, and environment, which are important for competitiveness, economic growth, and job creation.'

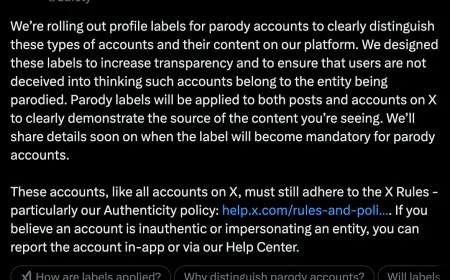

Ahead of the upcoming budget, industry body CII presented a 10-point agenda to promote ease of doing business reforms. It aims to reduce the compliance burden, simplify the regulatory framework, and improve transparency. Under 'immediate policy interventions', CII suggested that all regulatory approvals - at the central, state, and local levels - should be mandatorily provided only through the National Single Window System. Further, CII proposed enhancing the capacity of courts to expedite the dispute settlement process and relying more on alternative dispute resolution (ADR) mechanisms.

To make environmental compliance easier, CII suggested a single-window framework that would bring all requirements together into a single document. It also said that to facilitate easy availability of land for businesses, states could be encouraged to develop an online integrated land authority that would aim at simplifying land banks, digitizing land records, and making available information on disputed land.

To facilitate land acquisition at the national level, CII recommended that the India Industrial Land Bank (IILB) be made a national land bank that could be supported through the Union Budget. CII also said that India has focused on improving the ease of doing business over the past decade but the process needs to be continued in some specific areas. CII also suggested that a law be passed to ensure timely processing of industry applications and delivery of services from central ministries, with a legal obligation on all public authorities for timely delivery of services and redressal of grievances.

Speaking of the importance of improving business facilitation, CII said that there is a need to make the Authorised Economic Operator Programme, which provides a number of preferential approvals to members, more attractive and easier to join, as part of its 10-point agenda. While identifying the 'high and rising pendency of tax disputes' as a key issue, CII said there is a need to reduce income tax litigation by reducing pendency at the level of Commissioner of Income Tax (Appeals) and improve the effectiveness of ADR mechanisms such as Advance Pricing Agreement, Advance Ruling Board and Dispute Resolution Scheme as part of EODB reforms.