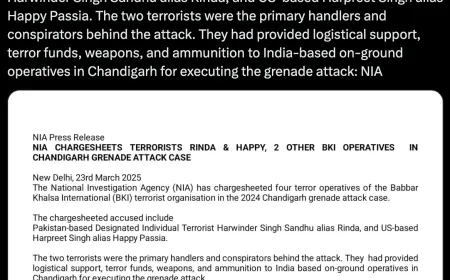

Banks should not charge excessive fees on priority sector loans up to Rs 50,000, RBI issued guidelines

Reserve Bank of India: The Reserve Bank of India (RBI) has asked banks not to charge excessive fees in the new master directive issued on priority sector lending (PSL). These instructions will come into effect from April 1, 2025. Let us know what the central bank has said in these guidelines.

The Reserve Bank of India (RBI) has made it clear that banks cannot charge excessive fees, especially on small loan amounts under the priority sector lending (PSL) category. The central bank said that no service charge or inspection fee will be levied on priority sector loans up to Rs 50,000. This move of the bank aims to protect small borrowers from unnecessary financial burdens and ensure fair lending practices.

The Reserve Bank of India (RBI) has said this in the new master directive issued on priority sector lending (PSL). These instructions will come into effect from April 1, 2025. In these guidelines, the central bank has also clarified that loans taken by banks against gold jewelry purchased from non-banking financial companies (NBFCs) will not be considered under the priority sector lending category. Banks cannot classify such loans as part of their PSL targets.

The move is aimed at ensuring that priority sector funds reach the sectors that actually need finance, such as small business, agriculture, and weaker sections of society. It said, "Loans taken by banks against gold jewelry bought from NBFCs are not eligible for priority sector status".

RBI has also ensured that all the loans covered under the earlier PSL guidelines (2020 framework) will continue to be eligible under the priority sector category till their maturity. The central bank has declared that for better compliance with PSL targets, RBI will have a more rigorous monitoring system. The banks will now have to provide detailed information about their priority sector loans on a quarterly and yearly basis.

RBI has also confirmed that outstanding loans given under specific COVID-19 relief measures will continue to be classified as priority sector loans. This decision is aimed at supporting sectors that are still recovering from the economic impact of the pandemic.

For Latest News update Subscribe to Sangri Today's Broadcast channels on Google News | Telegram | WhatsApp

.jpeg)

.jpeg)