Adani Group raised 1,250 crores through bond sale, first major fundraise after Hindenburg report

Billionaire Gautam Adani's flagship company has raised Rs 1250 crore through the sale of local currency bonds for the first time since January 2023, according to a report published by American short seller firm Hindenburg.

Billionaire Gautam Adani's flagship company has raised Rs 1,250 crore through local-currency bond sales for the first time since January 2023, US short seller firm Hindenburg reported.

According to NSDL data, Adani Enterprises has raised fresh debt by pledging 21.4 percent shares of Adani Road Transport. It has pledged 1.95 percent shares of Adani Road Transport during the September 2022 bond issue.

In a stock exchange filing, Adani Enterprises Ltd said it raised Rs 1,250 crore from the allotment of 1,25,000 secured, unrated, unrated, redeemable, non-convertible debentures (NCDs) of the face value of Rs 1 lakh each on a private placement basis Are.

Adani Group has not disclosed the interest rate at present, but according to the information received from the data of National Securities Depository Limited, the three-year bond has an annual coupon of 10 percent. Adani Group has forayed into the local corporate bond market following the Hindenburg Research report.

Let us tell you that Adani Enterprises last raised funds through the primary placement of bonds at a yield of 8.40 percent for 17 months in September last year. At that time, the Adani group raised funds at a premium of 140 basis points to government bond yields.

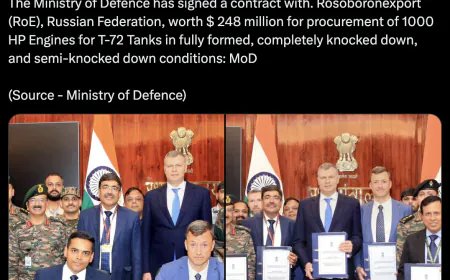

American short-seller firm Hindenburg Research released a report in January alleging fraud and stock price manipulation on the Adani Group, leading to a stock market crash. The Adani group had suffered a loss of around USD 145 billion since the report.

However, since the release of this report, the Adani Group has denied all of Hindenburg's allegations and is now planning a comeback strategy that includes reshaping its ambitions, scrapping acquisitions, and addressing concerns about its cash flow and borrowings. These include prepaying loans and reducing the pace of spending on new projects.

For Latest News update Subscribe to Sangri Today's Broadcast channels on Google News | Telegram | WhatsApp

.jpeg)